PesaZetu: P2P Lending Platform

Startup / SaaS / USSD / Payments

Challenge

The opportunity and finance gap in Africa needs bridging. Kenyans being entrepreneurial in nature, are diligent in building businesses that serve critical customer bases with essential services albeit mostly in the informal, undocumented sector. However, lack of financial access instigates challenges for entrepreneurs taking away their ability to ride on opportunities.

Project Goals

- Build a peer to peer market connecting individual borrowers and lenders

- Create a seamless customer journey through all channels with MPESA as the initial mode of payment

- Manage multiple integrations and inputs into the loan process for scoring

- Create a real-time loan application, funding and disbursement workflow

Our Solution

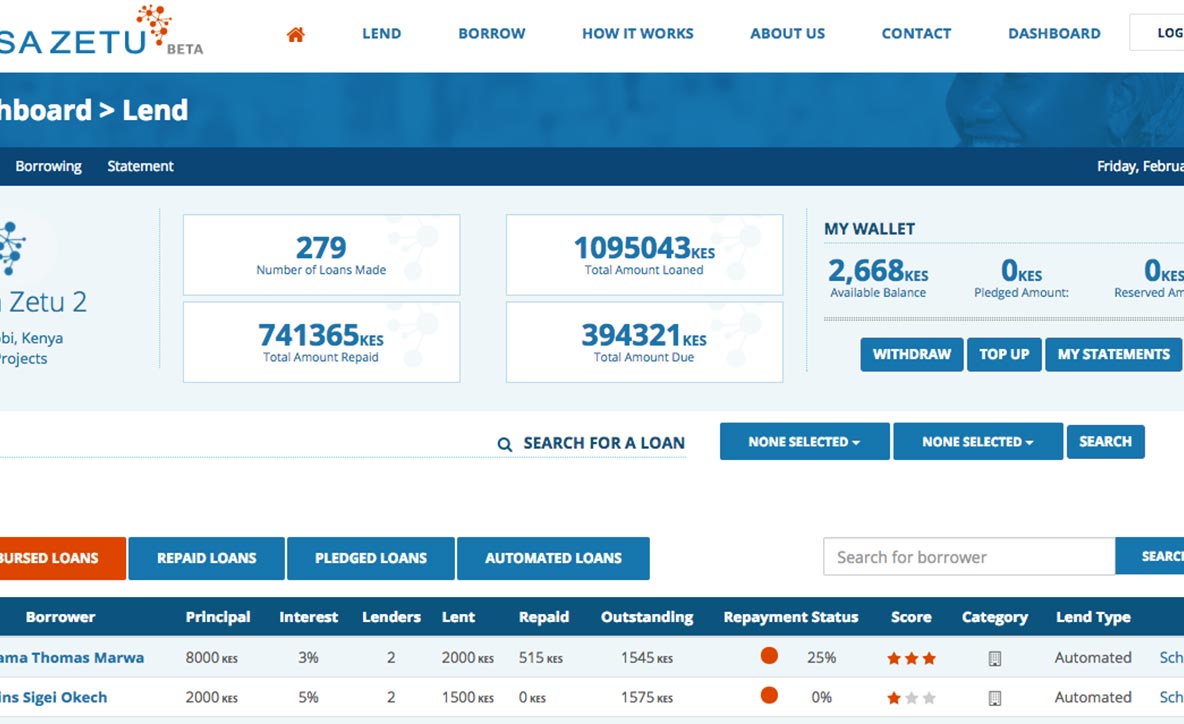

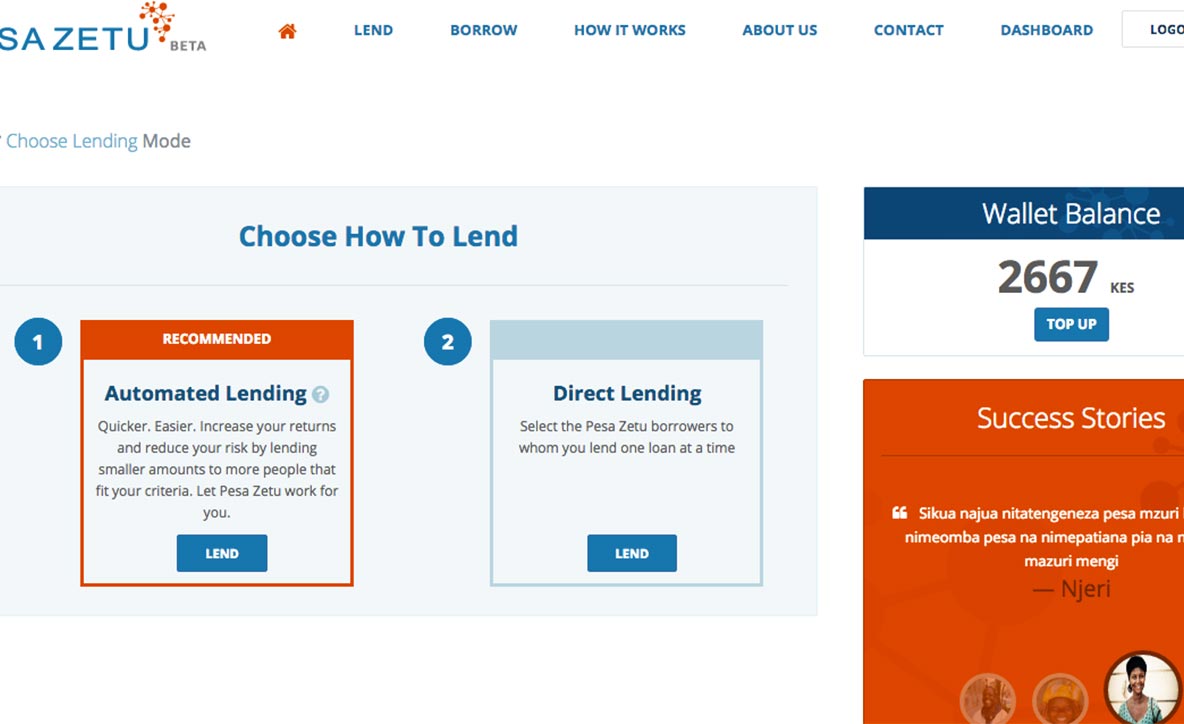

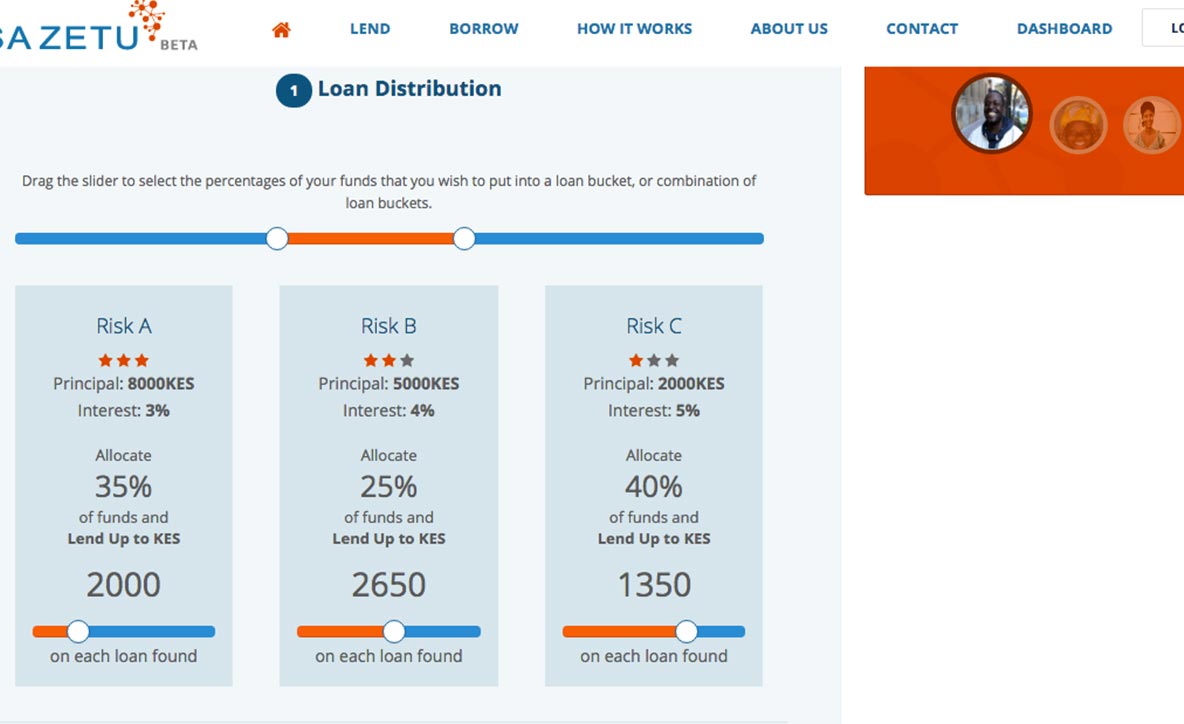

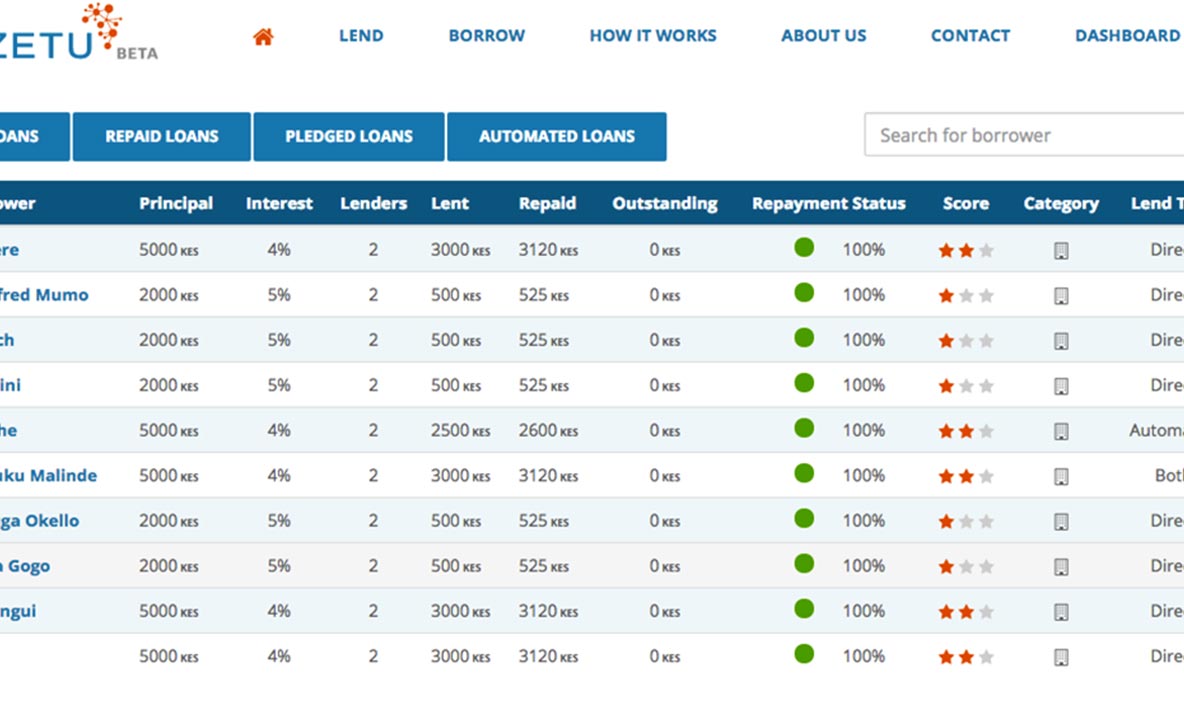

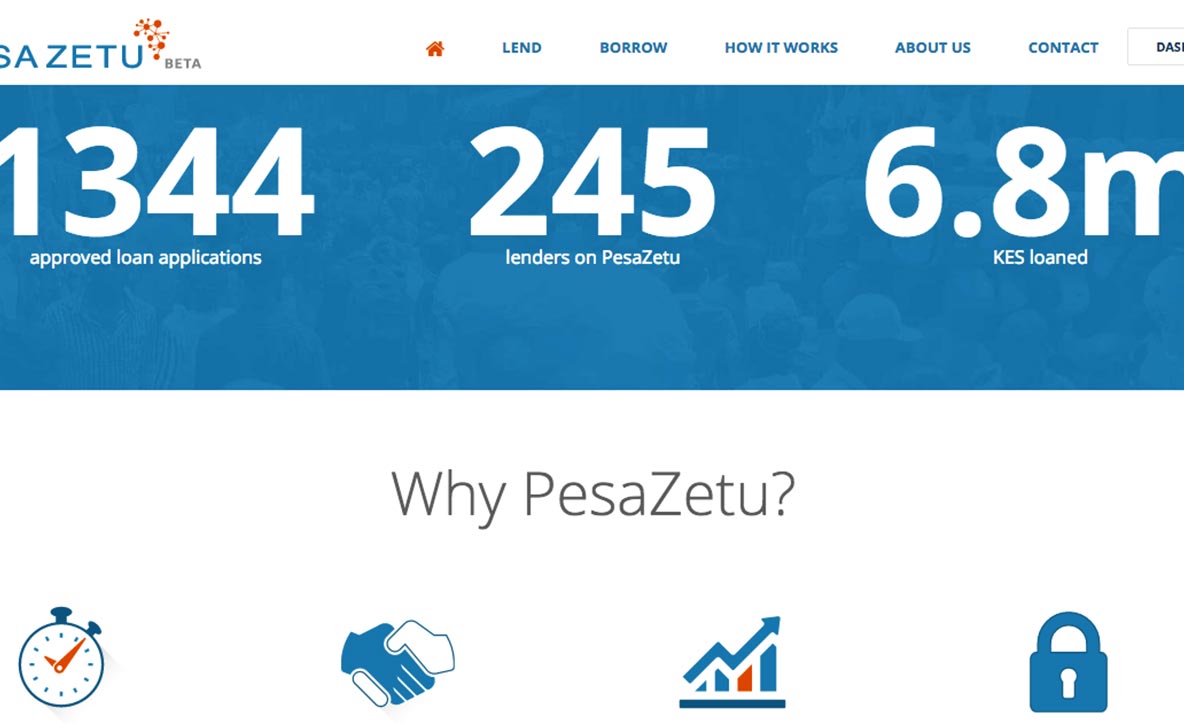

Pesa Zetu is a crowdfunding platform that aims to give borrowers small loans for business, health and educational purposes. The funding sources come from individual lenders on the platform and uses MPESA for the disbursements of loans and collections of repayments. Each borrower goes through risk profiling where multiple datapoint are used to assess the borrowers credit worthiness and debt burden capacity. These data points combine information from MPESA, Government database, Credit Reference Bureau and behavioural user generated data; more than 2000 individual datapoints per borrower. Using a state of the art credit risk model, Pesa Zetu then offers the best loans to our borrowers. Lender can lend manually by picking the loans they want or can set up preferences for automated lending allocation. This automatically allocates funds to loans and automatically recycles repayments based on the lenders risk profile settings.

Results

Pesa Zetu was built on Ruby on rails with web, USSD and API interfaces. It successfully integrates with MPESA, Credit reference Bureau, Govermnet database(IPRS), Collection management system and Scoring algorithm to offer real-time loan approvals and disbursements.

Get in touchWorking on PesaZetu has been one of the most challenging and exciting moments of my career. We started off with a dream, aiming to disrupt the lending and credit industry. We were the first in the subsaharan region to offer a truely peer to peer lending experience. I truely commend zegetech for pulling this one off. If there's any one team that can do it (and by it i mean that system that seems next to impossible), its zegetech